2016 was the year in which blockchain theory achieved general acceptance, but remained in theory, with the big players lingering around the hoop waiting to see who would take the first shot. As the year comes to an end, blockchain technology is tantalizingly close to turning the corner and entering the realm of small-scale commercializability. Overall, 2017 is going to be the year of the very well-considered and well-funded proof of concept, with a few projects achieving revenue positive status.

What is Blockchain ?

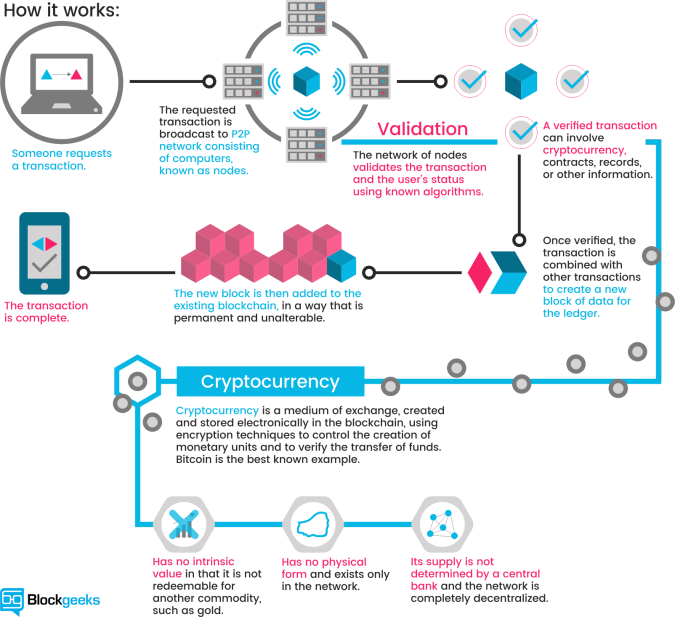

Blockchain is an incorruptible Digital ledger and a secure way to exchange funds without the involvement of a central financial authority. It can record not just financial transactions but virtually everything of value.

Today surely, we can make payments with our phones and send and receive money online, but the transactions are still processed and verified by the same large financial institutions and middlemen. That means steep transaction fees, long wait times and lots of room for human error.

The possible solution is Blockchain — a decentralized, distributed database that makes the cryptocurrency bitcoin possible — is poised to permanently disrupt the way we think about money, from transferring funds to making day-to-day purchases to the very concept of a national currency.

The first blockchain was conceptualised by Satoshi Nakamoto in 2008 and implemented the following year as a core component of the digital currency bitcoin, where it serves as the public ledger for all transactions.

Through the use of a peer-to-peer network and a distributed timestamping server, a blockchain database is managed autonomously. The invention of the blockchain for bitcoin made it the first digital currency to solve the double spending problem, without the use of a trusted authority or central server. The bitcoin design has been the inspiration for other applications.

By design blockchains are inherently resistant to modification of the data — once recorded, the data in a block cannot be altered retroactively. Blockchains are “an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. The ledger itself can also be programmed to trigger transactions automatically.

A blockchain facilitates secure online transactions. A blockchain is a decentralized digital ledger that records transactions on thousands of computers globally in such a way that the registered transactions cannot be altered retrospectively.

Blockchain is the technology most likely to have the greatest impact on the next few decades. At its simplest, blockchain is a digital ledger of transactions shared across a global network of powerful computers. It uses cryptography to allow each participant on the network to add to the ledger in a secure way without the need for a central authority.

Why the name is Blockchain ?

Each time a digital payment or transfer is made to the ledger, every computer on the network sees the transaction and verifies it instantly using open-source software. All of the information tied to the transaction is then stored in a unit called a “block.” Each block contains a timestamp and a link to a previous block and each block is digitally stacked, one next to the other, in a chronological chain. Hence the term blockchain.

Image Source – Blockgeeks

Is transparent and incorruptible

The blockchain network lives in a state of consensus, one that automatically checks in with itself every ten minutes. A kind of self-auditing ecosystem of a digital value, the network reconciles every transaction that happens in ten-minute intervals. Each group of these transactions is referred to as a “block”. Two important properties result from this:

- Transparency – Data is embedded within the network as a whole, by definition it is public.

- It cannot be corrupted – Altering any unit of information on the blockchain would mean using a huge amount of computing power to override the entire network.

Blockchain durability and robustness

Blockchain technology is like the internet in that it has a built-in robustness. By storing blocks of information that are identical across its network, the blockchain cannot:

- Be controlled by any single entity.

- Has no single point of failure.

This is completely different from how financial institutions operate today.

If a bank in India wants to send $100 to a bank in USA, each side maintains its own record of the transaction. Teams of accountants and bookkeepers and auditors oversee every transfer and payment to ensure that $100 is really subtracted from the account in India and credited to the account in USA.

Dependability and transparency are big selling points of blockchain. Instead of relying on humans to check for errors and fraud, the software polices itself by tapping the collective processing power of millions of networked computers. And once a transaction is stored on the blockchain, it’s visible to everyone and unchangeable — forever.

Movement in that direction is beginning to pick up speed. On an individual level, people can already use blockchain to pay for goods and services or send each other money — instantly and without fees — using bitcoin or other digital currencies. But it still requires a middleman to convert the digital currency back to dollars.

The next big step is for central banks to issue their national currencies on blockchains. This way, you’ll have something on the blockchain that has exactly the same value and reliability as a regular euro or dollar, but now you have it on this infrastructure, which is the most effective way to move money in the world.

There are already a handful of countries actively shifting to digital currencies powered by blockchain technology. Tunisia has invested heavily in the electronic payment and exchange system eDinar, and is partnering with the Swiss firm Monetas to enable mobile digital payments and in-person transactions at any of the North African nation’s post offices. In India, Prime Minister Narenda Modi has pulled much of the country’s paper currency from circulation, and the Indian state of Goa has vowed to go “cashless” in 2017, promoting the use of mobile payments and credit card terminals, even in humble fish markets.

If all banks used blockchains to settle their international transfers, we could almost eliminate money laundering on a large international scale, because the system is too transparent to hide it.

Applying blockchain across industries and professions

Blockchain shows great promise across a wide range of business applications

For example, financial institutions can settle securities in minutes instead of days. Manufacturers can reduce product recalls by sharing production logs with original equipment manufacturers (OEMs) and regulators. Businesses of all types can more closely manage the flow of goods and related payments with greater speed and less risk.

- Finance

- Banking

- Healthcare

- Government

- Manufacturing

- Insurance

- Retail

- Legal

- Media and Entertainment

- Supply Chain and Logistics

- Finance and Accounting